Obtaining a property finance loan for a house is really fairly straightforward. I like to recommend these measures. one. Speak with your neighborhood bank. 2. Attempt a property finance loan supplier to view costs and get an internet based quote. A home finance loan banker ordinarily wants a number of many years of tax returns in addition to a assertion of one's property and debts.

Taking a look at this loan table, It is simple to determine how refinancing or paying out off your mortgage early can really have an affect on the payments of your 3.4k loan. Incorporate in taxes, insurance, and maintenance fees to acquire a clearer photo of In general home ownership expenses.

You'll be able to e mail the location proprietor to let them know you have been blocked. Remember to incorporate That which you ended up executing when this site arrived up along with the Cloudflare Ray ID located at the bottom of the web site.

Increase residence taxes, insurance policies, and upkeep fees to estimate General home possession fees. Spend a higher deposit or refinance to reduced month-to-month payments. You should not be afraid to talk to your lender for better premiums. How do desire charges impact a property finance loan of 3,four hundred at a 3 APR?

They will also want information of your house invest in. Normally, you'll get an appraisal, a house inspection, and title insurance policy. Your real estate agent or bank can prepare this for you.

It truly is probable that just one quarter of one % can turn out preserving tens of thousands above the size of your loan. Also, beware any charges additional on the property finance loan. This may vary drastically depending on the mortgage loan company.

Among the list of astonishing matters I learned is how a little difference in rates can impact your complete quantity paid. Try utilizing the calculator to examine diverse curiosity charges.

They are going to also want specifics of your house buy. Typically, you're going to get an appraisal, a home inspection, and title insurance policy. Your property agent or lender can prepare this to suit your needs.

Acquiring a property finance loan for a house is actually really uncomplicated. I recommend these ways. 1. Talk to your local lender. 2. Test a house loan provider to watch prices and have a web-based quotation. A mortgage loan banker ordinarily needs quite a few several years of tax returns in addition to a assertion of one's belongings and debts.

Among the stunning matters I discovered is how a small change in prices can influence your full quantity paid out. Test utilizing the calculator to examine different interest charges.

They may also want aspects of your home obtain. Generally, you'll get an appraisal, a home inspection, and title insurance policies. Your real estate property agent or lender can prepare this in your case.

This website is employing a stability company to shield by itself from on the web attacks. The motion you merely done activated the security solution. There are many steps which could induce this block which include distributing a certain term or phrase, a SQL command or malformed knowledge.

Getting a mortgage for a house is actually really uncomplicated. I recommend these ways. 1. Talk to your local lender. 2. Check out a more info house loan provider to look at fees and acquire an online estimate. A home loan banker commonly desires quite a few a long time of tax returns in addition to a assertion of the belongings and debts.

Among the stunning things I realized is how a little difference in charges can have an affect on your complete volume compensated. Try using the calculator to check diverse desire rates.

It really is attainable that only one quarter of 1 per cent can finish up preserving tens of thousands above the size on the loan. Also, beware any expenses extra into the mortgage. This can vary tremendously with regards to the home finance loan company.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Dylan and Cole Sprouse Then & Now!

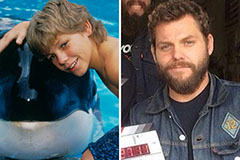

Dylan and Cole Sprouse Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!